How to Use the Live Forex Correlation Matrix for Smarter Trading Decisions

📊 How to Use the Live Forex Correlation Matrix for Smarter Trading Decisions

In the world of Forex trading, understanding the interconnectedness of currency pairs can make all the difference in your strategy. One of the most insightful tools for this purpose is the Live Forex Correlation Matrix.

This powerful, real-time tool helps traders like you monitor the relationships between different currency pairs, allowing you to spot trends, confirm trade ideas, and avoid risks. Let’s dive into what the Forex correlation matrix is, how it works, and how you can use it to elevate your trading game.

🔗 What Is the Live Forex Correlation Matrix?

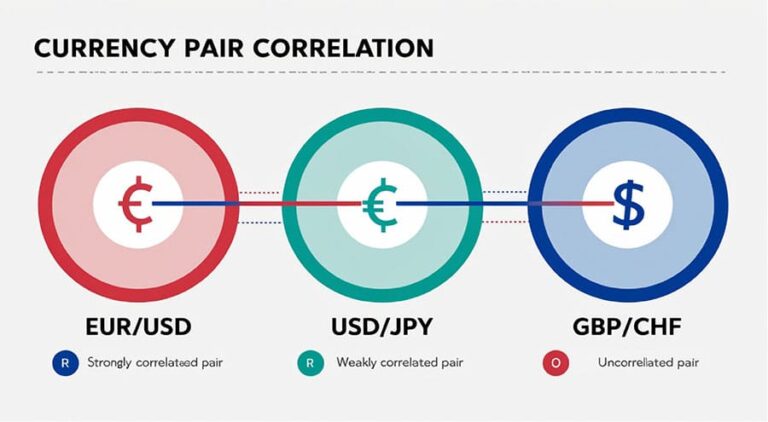

A Forex Correlation Matrix is a dynamic table that shows how currency pairs are related to one another, ranging from -1 (strong negative correlation) to +1 (strong positive correlation).

- Positive correlation (+1) means both currency pairs typically move in the same direction.

- Negative correlation (-1) indicates the pairs move in opposite directions.

- A correlation of 0 shows no relationship between the pairs.

With a live matrix, these correlations are updated in real-time, giving traders a fresh perspective on how currency pairs interact as the market fluctuates.

🔍 Why Should You Care About the Forex Correlation Matrix?

The Forex Correlation Matrix is more than just a handy chart. It provides actionable insights that help you make better-informed trading decisions:

✅ 1. Enhance Trade Validity

By checking the matrix, you can validate your trades. For instance, if EUR/USD and GBP/USD are showing similar patterns, your long position on both pairs is likely more reliable.

✅ 2. Avoid Risky Overexposure

Trading highly correlated pairs could lead to overexposure to the same market move. By analyzing the matrix, you can diversify your trades and avoid opening multiple positions based on the same market movement.

✅ 3. Spot Divergences

A divergence between correlated pairs is a strong signal. If one pair is moving up and the other is moving down, this divergence could indicate a potential market reversal, giving you a heads-up to adjust your trades.

✅ 4. Make Smarter Portfolio Decisions

By observing real-time correlations, you can diversify your trading portfolio, choosing pairs that don’t move in sync to reduce overall market risk.

📈 How to Effectively Use the Live Forex Correlation Matrix

🔹 Step 1: Access the Matrix

To begin, use a live Forex correlation matrix on platforms like MetaTrader or TradingView. This will show you the updated relationships between various currency pairs in real time.

🔹 Step 2: Analyze Correlations

Look at the matrix for strong correlations:

- High positive correlation (+0.80 to +1): Indicates pairs are likely to move in the same direction. For example, EUR/USD and GBP/USD often show positive correlations because both currencies are affected similarly by global economic factors.

- High negative correlation (-0.80 to -1): Indicates pairs are likely to move in opposite directions. For example, EUR/USD and USD/CHF tend to move in opposite directions due to their opposing relationship with the USD.

🔹 Step 3: Look for Confirmation or Divergence

- Confirmation: When two or more highly correlated pairs move in the same direction, you have confirmation for your trade. For example, if both EUR/USD and GBP/USD break through resistance levels, this gives added weight to your decision to go long.

- Divergence: When correlated pairs start moving in opposite directions, it’s a warning signal that the trend may be weakening or reversing. This is an excellent time to reassess your positions and adjust if necessary.

🔹 Step 4: Diversify Your Risk

If you’re trading pairs that have strong positive correlations, consider diversifying by adding pairs with negative or zero correlations. This will help you avoid being overexposed to the same risk factors.

🔄 Example: How the Live Forex Correlation Matrix Can Help

Let’s break this down with an example using the following correlation values:

| Pairs | EUR/USD | GBP/USD | USD/JPY | AUD/USD | USD/CHF |

|---|---|---|---|---|---|

| EUR/USD | 1.00 | 0.85 | -0.30 | 0.50 | -0.75 |

| GBP/USD | 0.85 | 1.00 | -0.25 | 0.55 | -0.70 |

If you’re trading EUR/USD and you see a bullish breakout, check GBP/USD to see if it shows a similar move. If it does, your bullish bias is more likely to be accurate.

However, if USD/CHF (a negatively correlated pair) is moving in the opposite direction of EUR/USD, you might want to reconsider your trade. This divergence suggests that the USD might be strengthening, which could cause a reversal in EUR/USD.

📌 Conclusion: The Benefits of a Live Forex Correlation Matrix

The Live Forex Correlation Matrix is a must-have tool for any trader who wants to refine their trading strategy. By understanding how currency pairs move relative to each other, you can make more informed decisions, reduce risk, and optimize your portfolio.

The matrix helps you spot confirmation, divergence, and overexposure, leading to smarter, more strategic trades. With the real-time updates it offers, you can stay ahead of the market and trade with confidence.