Breaking Down Currency Pairs: Your First Step Into Forex Trading

If you’re stepping into Forex for the first time, one term you’ll encounter almost immediately is “currency pair.” It may sound technical, but it’s actually the building block of how trading in the foreign exchange market works.

In this guide, we’ll walk you through what currency pairs are, how to understand them, and why they’re essential to your success in Forex.

🔄 What Exactly Is a Currency Pair?

Forex trading involves the exchange of one currency for another—which is why currencies are always traded in pairs. A currency pair shows how much of one currency (the quote) is needed to buy another (the base).

Take USD/JPY for example: it shows how many Japanese Yen (JPY) are required to purchase one U.S. Dollar (USD).

📘 Base vs Quote: Understanding the Format

Each currency pair is made up of:

- Base Currency: The first currency in the pair (e.g., USD in USD/JPY)

- Quote Currency: The second one, which is used to measure the value of the base (e.g., JPY)

If USD/JPY = 150.00, it means 1 USD = 150 Yen. If that number goes up, the dollar is getting stronger relative to the yen.

🌍 Categories of Currency Pairs

Currency pairs are grouped into three main categories:

- Majors – Heavily traded pairs including the USD, like EUR/USD or USD/CHF.

- Minors – Pairs that exclude the USD but involve strong economies, like GBP/JPY.

- Exotics – One major currency and one from a developing economy, such as USD/MXN or EUR/TRY.

👉 Want to go deeper? Check out our article on Different Types of Currency Pairs (placeholder for internal link)

📈 Why Currency Pairs Matter to You

Knowing how currency pairs function helps you:

- Identify trends and momentum

- Understand global economic relationships

- Plan effective trade setups

- Avoid beginner mistakes like overexposure

For example, if economic data favors the UK over the US, you might see GBP/USD rise in value, showing the pound gaining strength.

💹 Forex Quotes Made Easy

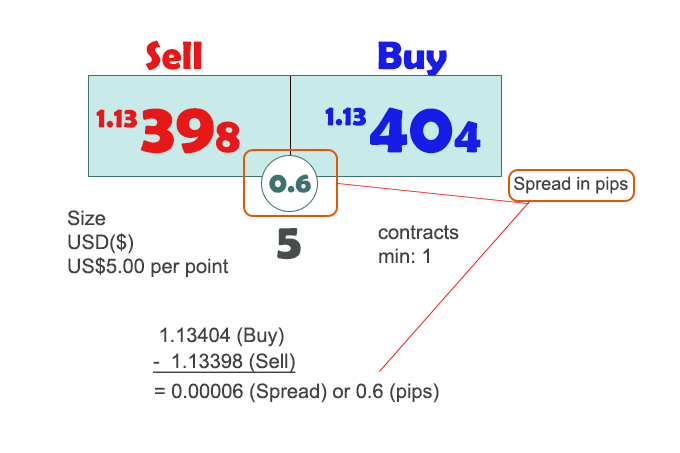

A typical Forex quote looks like this: GBP/USD 1.2850 / 1.2853

- Bid Price: What buyers are willing to pay (you sell here)

- Ask Price: What sellers want (you buy here)

- Spread: The small difference between bid and ask—this is essentially the broker’s fee

👉 Need help understanding spreads and cost? read our article on How Forex Brokers Make Money

🔗 Currency Pair Relationships

Some pairs tend to move in sync, while others go in opposite directions. Understanding this dynamic—called correlation—can help you avoid doubling your risk or missing hedge opportunities.

👉 Look out for our guide on Currency Correlations and Their Impact

🎯 Final Insight

If you’re just beginning your trading journey, mastering how currency pairs work will give you a clear advantage. Every Forex decision you make will revolve around the price movements of a pair—so it’s more than just theory, it’s your trading reality.

From majors to exotics, each pair tells a story of economic strength, policy, and global money flow. Learn to read them, and you’ll be able to read the market itself.