Forex Trading: The Ultimate Guide for Beginners and Experts

What is Forex Trading?

Forex (Foreign Exchange) trading involves buying and selling currency pairs in a global market. It is the world’s largest financial market, with over $7 trillion traded daily. Traders profit by speculating on currency price movements.

Why Trade Forex?

Forex trading offers several advantages, including high liquidity, 24-hour market access, and leverage opportunities. Whether you’re a beginner or an experienced trader, the Forex market provides opportunities for profit.

Who Should Trade Forex?

- Beginners looking to explore financial markets

- Experienced traders aiming to diversify portfolios

- Businesses managing currency risks

- Investors seeking alternative investment opportunities

Learn Forex Basics

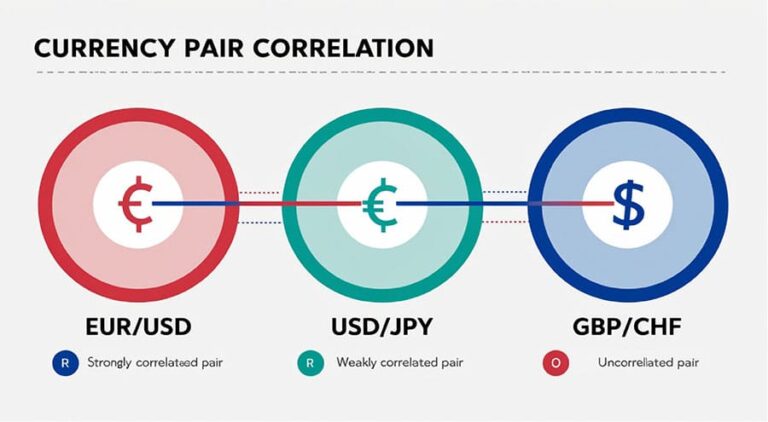

- Currency Pairs: Major, minor, and exotic pairs

- Pips and Spreads: Understanding price movements

- Leverage and Margin: Maximizing potential profits

- Market Sessions: Best times to trade

- Technical and Fundamental Analysis: Essential strategies

Essential Forex Trading Strategies

- Day Trading: Short-term trades within a single day

- Swing Trading: Holding trades for several days

- Scalping: Quick trades for small profits

- Trend Trading: Following long-term trends

Explore Forex Trading Strategies →

Enhance Your Forex Trading with Expert Advisors (EAs)

If you’re looking to automate your Forex trading strategies, Forex Expert Advisors (EAs) can be a game-changer. These advanced algorithms can help you execute trades based on predefined criteria, removing the emotional aspect from trading and ensuring more consistent results. EAs are designed to work with various trading platforms, offering a wide range of customization options for both beginners and experienced traders.

Interested in discovering the best Forex EAs for your trading strategy? Stay tuned for our upcoming page where we will feature a curated list of top-performing Forex Expert Advisors, complete with reviews, performance data, and more insights to help you choose the right one for your trading needs.

Learn More About Forex EAs and Choose the Best One for You →

Choosing the Best Forex Broker

Selecting the right broker is crucial for success in Forex trading. Consider:

- Regulation and Security (Check licensing authorities)

- Trading Platforms and Tools (MetaTrader, cTrader, etc.)

- Fees and Spreads (Low commissions for cost-effective trading)

- Customer Support (Reliable assistance when needed)

Risk Management in Forex

- Stop-Loss and Take-Profit Levels

- Position Sizing and Capital Allocation

- Avoiding Emotional Trading and Overleveraging

Learn More About Forex Risk Management →

Forex Market News and Updates

Stay informed with the latest Forex news, analysis, and trends to make informed trading decisions.

Whether you’re a novice stepping into the forex world or a seasoned trader fine-tuning your strategies, understanding the evolving dynamics of the foreign exchange market is essential. Forex trading offers unparalleled liquidity, global accessibility, and the potential for significant returns—but it also requires disciplined risk management, emotional control, and continuous learning. This ultimate guide aims to bridge the gap between basic concepts and advanced tactics, helping you trade with confidence, clarity, and consistency. By combining technical analysis, fundamental insights, and smart trading psychology, you position yourself to navigate market volatility and seize profitable opportunities across currencies. Remember, in forex, knowledge is your most powerful asset.

✅ Trusted Source Links

- Investopedia – Forex Trading: How to Trade the Forex Market

Covers beginner to intermediate topics including how forex markets operate, order types, and strategy fundamentals. - DailyFX – Forex for Beginners & Advanced Trading Guides

Offers structured learning for all levels, including expert-level topics like macroeconomic impact, advanced indicators, and risk modeling.