Forex trading is not just about executing random trades—it requires well-thought-out strategies that align with market trends and your trading style. In this guide, we’ve compiled a list of popular Forex trading strategies that traders of all levels can use. Each strategy is designed to capitalize on different market conditions, from volatile to stable markets. Click on each strategy to explore it in more detail.

Popular Forex Trading Strategies

- Scalping

A fast-paced strategy where traders execute numerous small trades to capture tiny price movements. Great for traders who thrive on speed and precision. - Day Trading

Involves entering and exiting trades within the same day to take advantage of short-term price movements. - Swing Trading

This strategy captures medium-term price movements over several days or weeks, riding the “swing” in market price fluctuations. - Trend Trading

Traders focus on identifying a strong trend (up or down) and enter positions in the direction of that trend, staying in for the long haul. - Breakout Trading

Targets significant price movements when the market breaks through key support or resistance levels. Traders enter the market when these breakouts occur. - Carry Trading

Involves borrowing low-interest-rate currencies to fund the purchase of currencies with higher interest rates, profiting from the interest rate differential. - Position Trading

A long-term strategy where traders hold positions for weeks, months, or even years, based on long-term market trends. - Range Trading

This strategy works in flat or non-trending markets. Traders buy at support levels and sell at resistance levels, making profits from price oscillations. - Scalping with Indicators

Combines quick trades with the use of technical indicators like moving averages, RSI, or MACD to make informed scalping decisions. - News Trading

Involves trading based on market-moving economic news. Traders capitalize on the sharp price movements that occur after important news releases. - Risk Reversal Strategy

Uses options to hedge your position and capitalize on directional market moves while managing risk. Popular in volatile markets. - Fibonacci Retracement

A strategy that uses Fibonacci levels to identify key support and resistance levels based on past price movements, offering potential entry points. - MACD Strategy

Uses the MACD (Moving Average Convergence Divergence) indicator to spot shifts in momentum and potential trade opportunities. - RSI (Relative Strength Index) Strategy

Utilizes the RSI to identify overbought or oversold conditions in the market and helps traders make buying or selling decisions accordingly. - Moving Average Crossover

A popular strategy where short-term moving averages cross over long-term moving averages to signal potential buy or sell opportunities. - Double Top and Bottom Strategy

A reversal pattern that helps traders identify market trend shifts, signaling the potential end of an uptrend (double top) or downtrend (double bottom). - Price Action Trading

A method of trading based purely on price movements rather than indicators. Traders analyze historical price data to make predictions about future price movements. - Market Sentiment Analysis

Focuses on understanding the overall market sentiment (bullish or bearish) and aligning trades with prevailing market moods. - Risk Management Strategy

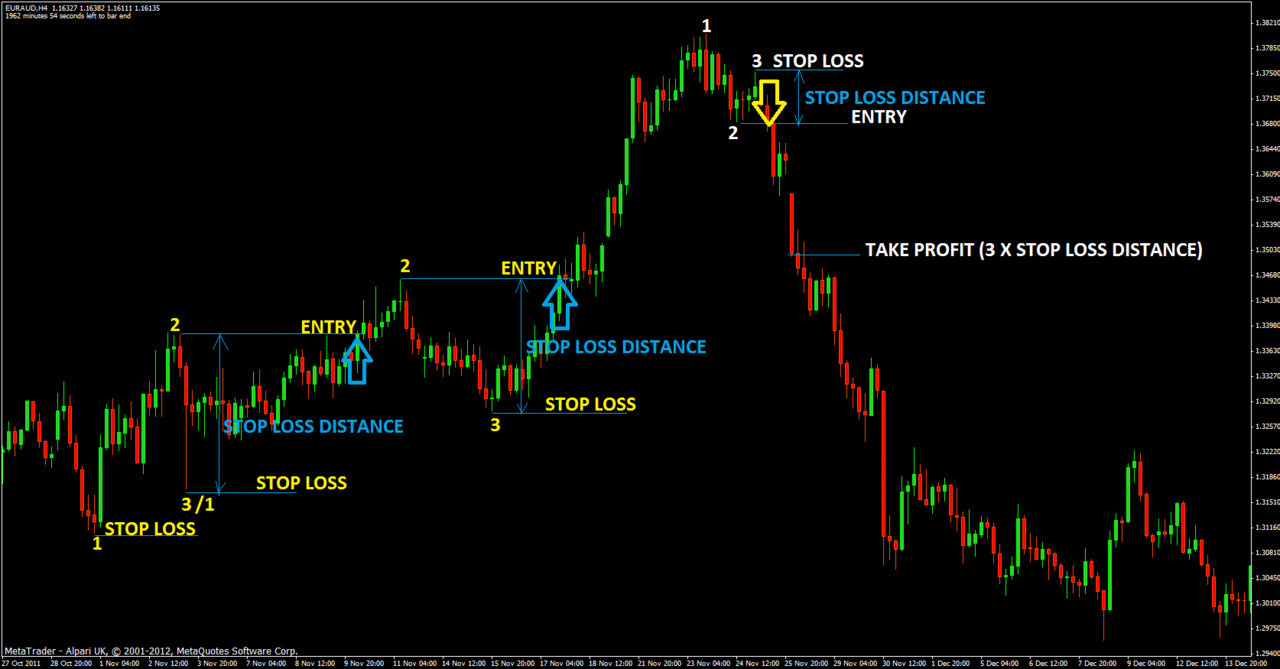

Emphasizes controlling risk and protecting capital through techniques such as stop-loss orders, position sizing, and diversification. - Ichimoku Cloud Strategy

A complete system that uses a combination of multiple indicators to identify market trends, support and resistance levels, and trade signals. - Hedging Strategy

Involves opening a position in the opposite direction of an existing trade to offset potential losses. Hedging helps protect against market uncertainty. - High-Frequency Trading (HFT)

A strategy that uses algorithms and powerful computers to place a large number of trades in a very short time, usually targeting small profits from large volumes. - Adaptive Moving Average (AMA)

This strategy uses an adaptive moving average to adjust to changing market conditions, allowing traders to ride trends while avoiding false signals. - Heikin Ashi Strategy

A candlestick charting technique that smoothens out price data to identify trends more clearly and avoid market noise. It is particularly useful for identifying short-term trends. - Divergence Trading Strategy

This strategy focuses on identifying divergence between price action and technical indicators like the RSI or MACD, which signals potential trend reversals. - Trendline Strategy

Involves drawing trendlines on price charts to identify potential areas of support and resistance. Traders use trendlines to make decisions based on price trends. - Martingale Strategy

A riskier strategy that involves doubling your trade size after a loss. The idea is that you’ll eventually win and recover all previous losses. However, this method can be risky if the market doesn’t cooperate. - Anti-Martingale (Reverse Martingale) Strategy

The opposite of the Martingale strategy, where traders increase their trade size after a win instead of a loss. This method aims to capitalize on winning streaks. - Candle Pattern Strategy

Uses specific candle formations like doji, hammer, or engulfing patterns to predict potential market movements based on price action. - Volume Spread Analysis (VSA)

A strategy that analyzes the relationship between price and volume to identify potential market manipulation, trend reversals, and price breakouts. - Arbitrage Trading

This strategy involves exploiting price discrepancies between two or more markets or instruments. Forex arbitrage can be highly profitable but requires precise timing and technology. - Geopolitical Trading Strategy

Focuses on trading based on political events, economic policies, and geopolitical tensions that can significantly affect currency values. - Break-and-Retest Strategy

A strategy where traders wait for a breakout of key support or resistance levels, and then enter the market after the price retests the breakout level. - Contrarian Strategy

Involves going against the market’s prevailing trend. Contrarians believe that the majority of traders are often wrong and that following the herd can lead to losses. - Multi-Timeframe Strategy

This strategy involves analyzing multiple timeframes to spot trends and reversals across different time periods. It helps traders confirm their decisions by using multiple perspectives.

Conclusion

With so many Forex trading strategies to choose from, finding the right one for your trading style is key to maximizing your profitability and managing risk. Whether you prefer short-term, high-frequency strategies or long-term investment approaches, there’s a strategy that suits your personality and goals.

Click on any strategy above to explore more about how it works and how you can implement it into your trading plan.

Happy Trading!

2 thoughts on “Forex Trading Strategies”