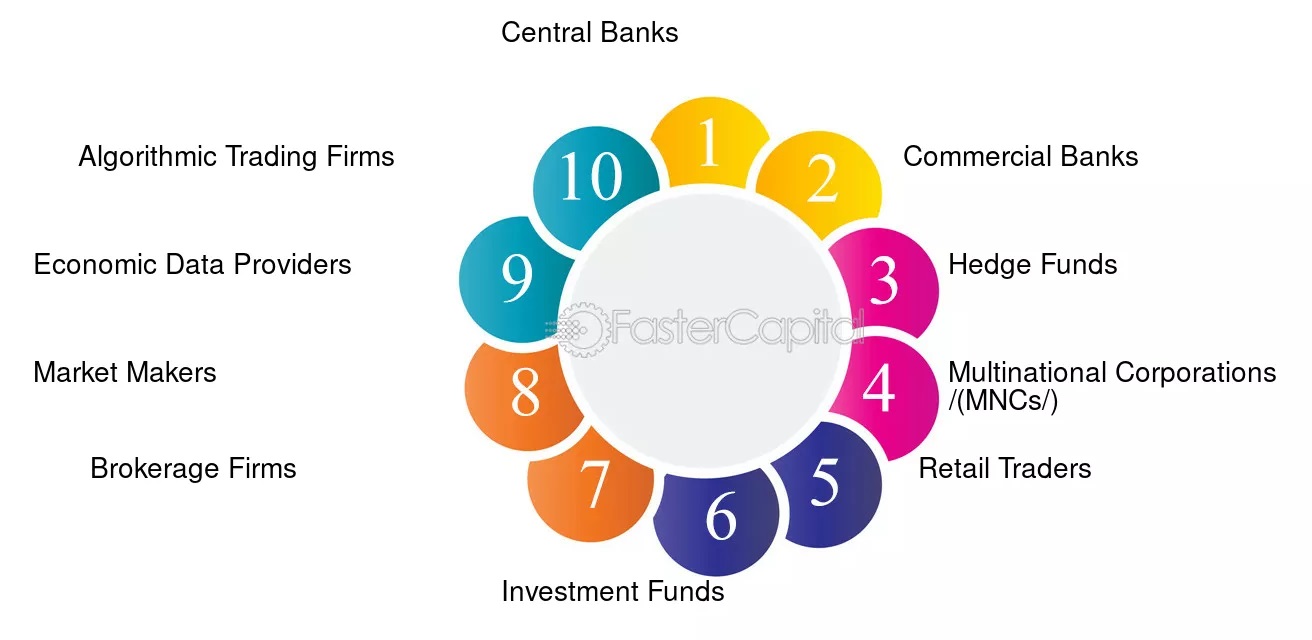

The Forex market is a dynamic and multifaceted space where various players contribute to its vast liquidity and price movements. Whether you’re a beginner or an experienced trader, understanding the key participants in the Forex market is crucial for making informed trading decisions. In this article, we’ll explore the different players in the Forex market, including retail traders, banks, and hedge funds, and examine their roles in shaping market dynamics.

1. Retail Traders: The Individual Investors

Retail traders are individual investors who trade Forex on online platforms, typically through brokers. These traders are often new to Forex or trade part-time as a hobby, but some also approach Forex as a full-time career. Retail traders can access the market with a relatively small amount of capital, thanks to leverage provided by Forex brokers.

Role of Retail Traders in the Forex Market:

- Market Liquidity: While retail traders account for a smaller portion of daily trading volume compared to institutional players, their collective participation helps ensure market liquidity. In fact, the growth of retail Forex trading in recent years has contributed to the market’s $7 trillion daily volume.

- Price Movements: Retail traders often react to news, economic data releases, and geopolitical events, driving short-term market fluctuations. As a result, their trading behavior can influence trends and contribute to overall market sentiment.

- Educational Impact: Retail traders often seek out educational resources to learn about technical analysis, trading strategies, and risk management. Their demand for educational tools has led to a wide array of courses, webinars, and platforms designed to help them improve their trading skills.

For those looking to start their journey in Forex trading, exploring the various strategies and understanding risk management are key. Learn about Forex strategies here to get started on the right foot.

2. Central Banks and Commercial Banks: The Market Movers

Central banks and commercial banks are among the most significant players in the Forex market. These institutions control the monetary policies of their respective countries and can influence currency values through their actions.

Central Banks:

Central banks, such as the Federal Reserve (USA), European Central Bank (ECB), and Bank of Japan (BOJ), play a pivotal role in managing their country’s economy. They do so by adjusting interest rates, conducting open market operations, and intervening in the Forex market when necessary. Central banks have immense influence over currency values because their policy decisions can cause significant shifts in market sentiment.

- Monetary Policy: Central banks use interest rates as a tool to control inflation and stimulate or cool down economic activity. When a central bank raises interest rates, the value of the currency often strengthens as investors seek higher returns. Conversely, when rates are lowered, the currency can weaken.

- Market Intervention: In some cases, central banks directly intervene in the Forex market to stabilize or influence the value of their currency. For example, during times of extreme volatility, a central bank may decide to buy or sell its currency to restore balance.

Commercial Banks:

Commercial banks, such as Goldman Sachs, JPMorgan Chase, and Barclays, engage in Forex trading as part of their broader financial activities. These banks play multiple roles in the market, including acting as market makers, providing liquidity, and facilitating international trade for clients.

- Market Makers: Commercial banks provide bid and ask prices for currency pairs and execute trades for clients. They also make money from the difference between these prices (the spread), ensuring liquidity in the Forex market.

- Forex Trading for Clients: Commercial banks trade Forex on behalf of large corporations, governments, and institutional investors, helping them hedge against currency risks associated with international trade and investments.

To understand the impact of central banks and commercial banks on Forex, it’s important to follow global economic news and central bank policies. Stay updated with global Forex news to gain deeper insights.

3. Hedge Funds: The Institutional Giants

Hedge funds are private investment funds that employ various strategies to generate returns for their investors. They are highly influential in the Forex market due to their significant capital and ability to move large volumes of money. Hedge funds often trade in large quantities and can take both short-term and long-term positions, making them key players in market dynamics.

Role of Hedge Funds in the Forex Market:

- Speculation and Profit-Seeking: Hedge funds are primarily focused on making profits from currency fluctuations. They do this by analyzing economic data, market sentiment, and geopolitical events to predict currency movements. The strategies employed by hedge funds include macro trading, carry trading, and trend following.

- Market Influence: Due to their substantial size and capital, hedge funds can have a significant impact on the Forex market. Large trades made by hedge funds can move currency prices, especially in less liquid markets.

- Hedging: Hedge funds use Forex trading as a way to hedge against risks in other areas of their portfolios. For example, they may take opposite positions in currency pairs to protect their investments from potential adverse movements in exchange rates.

Examples of Leading Hedge Funds in the Forex Market:

- Bridgewater Associates – One of the largest hedge funds globally, known for making big bets on macroeconomic trends, including Forex.

- Renaissance Technologies – A quant-driven hedge fund that uses algorithmic strategies to capitalize on currency price movements.

Hedge funds are typically private entities, but tracking their strategies and analyzing their impact on the market can provide valuable insights into how institutional players operate. Learn more about hedge fund strategies in Forex.

4. Other Key Players: Corporations and Governments

In addition to retail traders, banks, and hedge funds, corporations and governments are also active participants in the Forex market, albeit for different reasons.

- Corporations: Multinational companies engage in Forex trading to facilitate international trade, hedge against currency risk, and manage their balance sheets. For instance, a company that imports goods from the European Union may hedge its exposure to the Euro by taking positions in EUR/USD.

- Governments: Governments may intervene in the Forex market to stabilize their economy or to influence trade balance. Although this is less common, governments in certain countries may make direct interventions in the market to adjust the value of their currency.

Conclusion: Understanding the Forex Market Participants

The Forex market is influenced by a diverse group of players, each with their own objectives and strategies. Retail traders, commercial banks, hedge funds, and even central banks all contribute to the dynamic and often unpredictable nature of currency trading. By understanding the roles of these key players, you can gain a better grasp of market movements and make more informed trading decisions.

As you continue your journey into Forex, keep in mind that the market is shaped by these institutional players, and staying informed about their actions can provide valuable insights. For more in-depth resources on the role of different market participants, be sure to check out our other guides and tutorials.

Explore more about trading strategies

Stay updated with the latest Forex market news

Understanding the Forex market’s key players is an essential step toward becoming a successful trader. Happy trading!

One thought on “Exploring the Key Players in the Forex Market and Their Roles”